Payment Collection - Get Paid Faster and Easier

Automated Payment Collection

Chasing payments by hand wastes time and delays your income. The SAFE payment collection system handles the whole process from signup to reconciliation, improving your cash flow and reducing admin work.

Transform Your Cash Flow

End-to-End Payment Automation

SAFE automates the entire payment cycle:

- Customers set up their own payment details

- Card payments and Direct Debit options

- Auto-collect when invoices are due

- Instant alerts for failed payments

- Automatic payment matching

Multiple Payment Options

SAFE supports various payment methods:

Card Payments

Secure processing of credit/debit cards with continuous authorisation.

Direct Debit

Fully automated Direct Debit collection with GoCardless.

Invoice Payments

Secure payment links for quick online payment with real-time confirmation.

The Payment Collection Process

Customer Sign-up

Easy payment setup through your branded portal.

Invoice Creation

Auto-created invoices with payment notification emails.

Automatic Collection

System collects payment when invoices become due.

Matching

Payments automatically matched to invoices with full tracking.

Advanced Payment Features

The SAFE payment system includes sophisticated tools:

Branded Payment Messages

Professional payment notifications, receipts, and alerts that match your brand.

Top Security

PCI-DSS compliant with tokenisation so payment details never touch your systems.

Live Payment Dashboard

See payment status, collection rates, and upcoming payments in real-time.

Flexible Collection Timing

Set collection times to match invoice due dates.

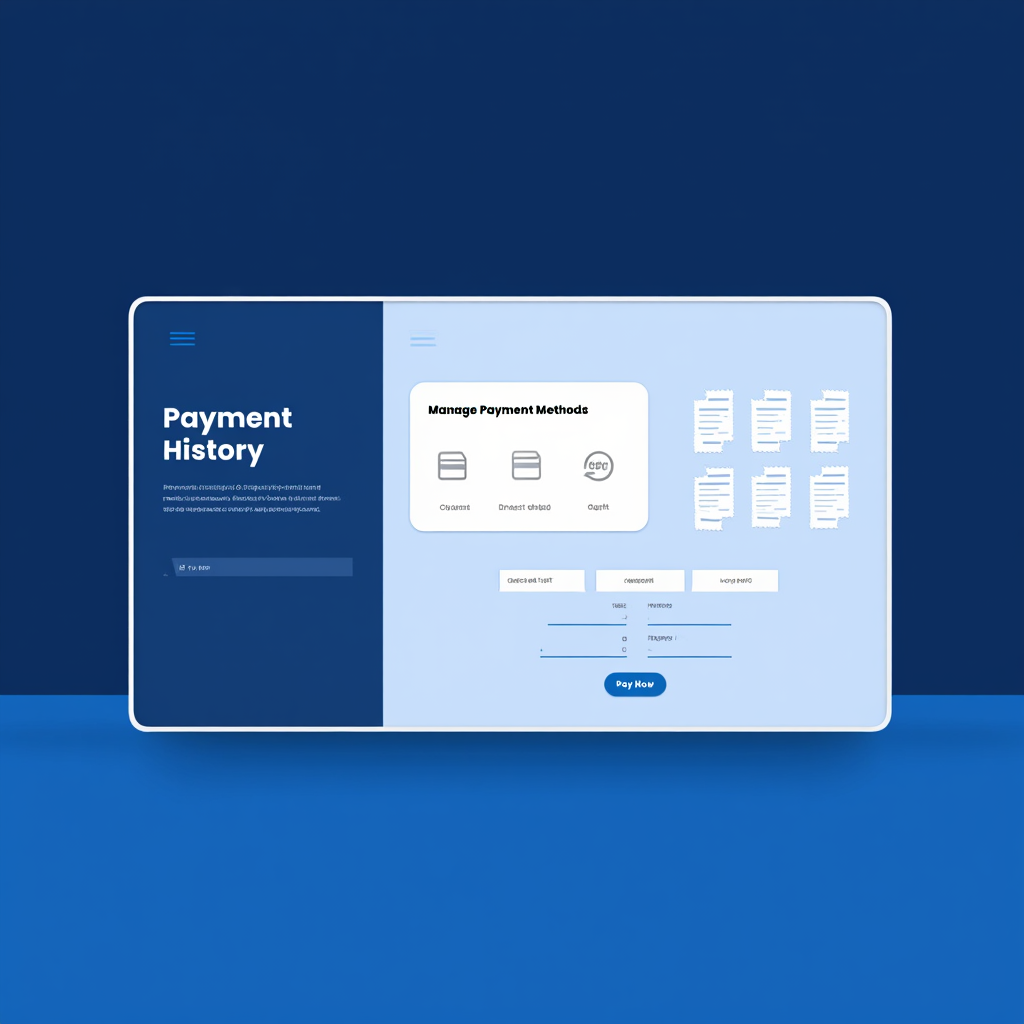

Self-Service Payment Management

Let customers manage their own payment methods:

Secure Payment Updates

Customers can update their payment details through a secure portal without calling you.

Payment History

Complete payment history, receipts, and statement access reduces support calls.

One-Time Payments

Customers can make one-time payments against outstanding invoices.

Reporting and Analytics

Turn payment data into useful insights:

Collection Performance

Track successful collections, failed payments, and collection rates

Cash Flow Forecasting

Project future cash flow based on scheduled collections

Customer Payment Insights

Identify at-risk customers based on payment patterns

Benefits of Automated Payment Collection

Better Cash Flow

Get paid 15 days faster on average with automatic collections on due dates.

Less Admin Work

End time spent on payment collection, follow-ups, and matching so your team can focus on growth.

Better Payment Accuracy

End human error in payment matching with automated linking of payments to invoices.

Better Customer Experience

Provide a more professional payment experience with clear communication and self-service.

The Cost of Manual Collections

What Manual Payment Collection Really Costs

For the average telecom reseller with 100 customers, manual payment collection wastes:

- 8+ hours per month processing and matching payments

- 4+ hours per month chasing late payments

- 2+ hours per month handling payment questions

Plus, manual collection usually means 15-20% of payments are at least 14 days late, hurting your cash flow. SAFE automated payment collection fixes these problems.